This week has been a game of two halves, economically speaking, for prospective house buyers.

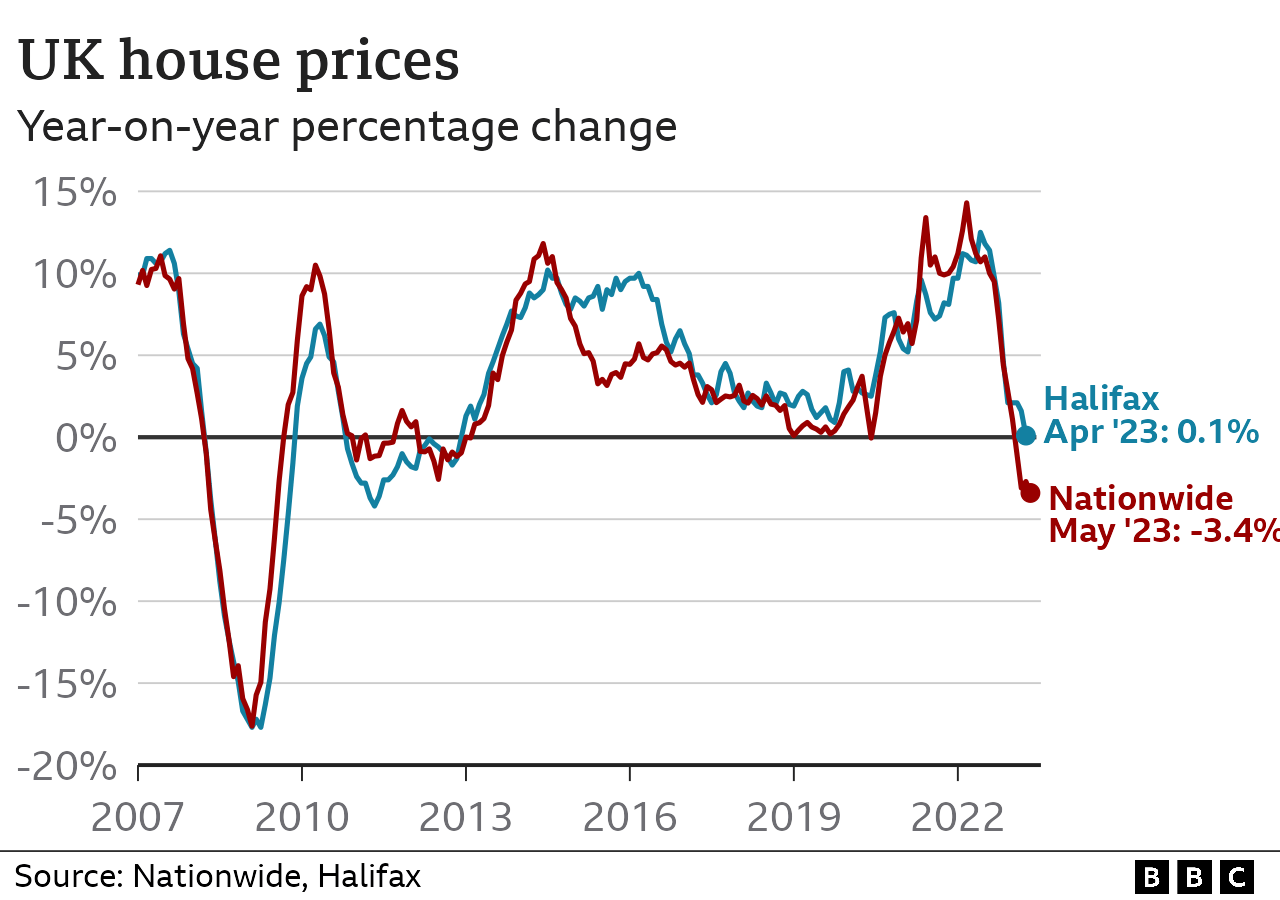

On Tuesday, the Nationwide building society said that house prices had recorded the biggest annual fall for 14 years.

Then on Thursday, the Bank of England hiked interest rates yet again.

Falling house prices should be good news for first-time buyers.

But with mortgage rates remaining high, things aren't quite as simple as they seem.

Are house prices actually falling?

It depends on how you look at it.

In the year to July, house prices dropped by 3.8% - that was the biggest annual fall since 2009, according to Nationwide.

However, the average price of a home in the UK remains high. It hit £260,828 in July, which is only marginally lower than the all-time record reached last August.

The housing market heated up because of the Covid pandemic, helped by a stamp duty holiday.

After being forced to work from home, cooped-up people decided they wanted more space inside and out, prompting a rush of buying, selling and moving.

The average house price is now £45,000 higher than it was in February 2020, the last full month before the pandemic struck, according to Nationwide.

Andrew Bailey, the governor of the Bank of England, has said house prices are falling. But don't expect a bargain just yet.

Mr Bailey pointed to the fact that the number of mortgages that were approved in June rose to 54,700 - the highest since last October - while total borrowing for mortgages rose from £19bn in May to £20bn in June.

Higher approvals and borrowing will support house prices in the coming months, said Mr Bailey.

"Yes, there is an adjustment," he told the BBC. "But I think we should avoid preaching crisis at this point, it's not that."

In fact, in its most recent Monetary Policy Report, the Bank said that house prices are expected to fall only "modestly" in the coming months.

Why are mortgages so expensive in the UK?

The interest that a bank charges you to borrow money for a house is heavily influenced by the rate set by the Bank of England.

Since late 2021, when the Bank of England's main interest rate stood at just 0.1%, it has been putting up rates to try to stop prices rising so quickly.

Inflation, which measures the rate at which prices are rising, is easing but at 7.9% in June, is still nearly four times higher than the Bank's 2% target.

On Thursday, the Bank increased rates for the 14th time in a row, taking them from 5% to 5.25%.

Recent rate rises have had a big knock-on impact of the cost of mortgages.

The average interest payment on a two-year fixed deal is currently 6.85%, according to financial data company Moneyfacts. For a five-year fixed mortgage, it is 6.37%.

By comparison, between July and September 2021, the average two-year rate was around 2.5%.

But there has been suggestions that the current interest rate level could be the peak for consumers, with banks and building societies starting to actually cut mortgage rates.

Mortgage rates are determined by what financial markets think the average UK interest rate will be over the next two or five years.

The five-year rate is sometimes lower than the two-year rate because investors might forecast that interest rates will come down at a later date.

I'm a first-time buyer - what now?

It's a bit of a rock and a hard place situation. A couple of years ago, the biggest problem facing first-time buyers was the deposit they needed to get on the property ladder, according to Nationwide.

Roughly speaking, between July and September 2021, the average house price was £208,757, and the average annual earnings for a full-time worker was just over £38,000, according to the Office for National Statistics.

A 10% deposit would be £20,875, which would be equal to 55% of average annual pay at that time - "an all-time high", said Robert Gardner, Nationwide's chief economist.

Read also: How to make money online in UK

"If you fast-forward to now, the deposit requirement is still high by historic standards," he said.

"It is not quite as high as it was relative to earnings because house prices have come down and people's incomes on average have gone up." he added